Crypto world is rapidly evolving – most people probably just heard about GPU mining, and some kind of electricity wasting while in fact it’s already started shaping financial landscape. DeFi in my opinion is the most significant milestone crypto has achieved so far.

What’s Defi? In simple words, it’s a decentralized financial world(i.e. without a single controlling body) where money flows fast and efficiently. Imagine you need to transfer money to your parents, there is no need to go to the bank, fill in forms and pay hefty admin fees (plus buy/sell conversion fees) and wait for several days until the money is arrived, all those can be done by a few clicks, with much less fee and within seconds.

Money transfer is one example however crypto can do more: generating passive income, like putting your money in a saving account and receive interests. How is this done? This is actually what we’re talking now: providing liquidity.

When you have some extra money, let’s say 1 Ethereum and 100 USD, instead of sitting in your wallet for nothing, you can put them into a liquidity pool and receive income at a rate that is much higher than any bank, for example 10% annually.

Is this too good to be true? Yes and No.

Yes – every investment has inherent risks, especially for crypto as there are a lot of uncertainties in this space, this is my strong warning before you continue 🙂

No – 10% is very likely given factors that crypto runs more efficiently(i.e. high liquidity), no middle-man fees, and crypto is a new world with lots of opportunities.

How can this be done? This is all because the introduction of liquidity pools in mid 2020, with DeFi exchanges like UniSwap, Curve Finance, Balancer and SushiSwap.

So what is a DeFi exchange and how do they make money?

Unlike traditional centralized share exchanges(like ASX in Australia), a DeFi exchange runs an algorithm to manage tokens in a liquidity pool and there is no central order book to fulfill buy/sell orders. This process is called Automated Market Maker (AMM). You can think AMM as a robot that is always willing to match buy/sell orders and it works 24×7.

Let’s take UniSwap for our demonstration.

The AMM adopted by UniSwap is simple:a pool must contain two tokens and the production of the number of tokens always remains the same at any given time. Let’s say a Ethereum(ETH) and USDT(digitized US dollar) pool, with 100 ETH and 10,000 USDT (this implies 1 ETH = 100 USDT=100 USD), so the production of 1,000,000 remains the same regardless of users activities of buy or sell (i.e. swap) of ETH/USDT.

When a user in this pool owns 1% of the total production, i.e. 1 ETH and 100 USDT, this user is called a liquidity provider (LP) and receives commissions charged by the pool for swap activities. You may wonder why people want to pay for fees to use the pool to swap their tokens(i.e. ETH and USDT), cannot they just hold their tokens without paying any fees? The answer is about money liquidity, because ETH price always fluctuates, people want to take opportunity to either make a profit or stop losing more, this is very similar to share trading activities.

A liquidity provider is almost guaranteed to incur an “impermanent loss”, due to ETH price fluctuation. This loss is called “impermanent” because if the user withdraws his tokens (e.g. ETH) at the same price as when they were deposited, there is no such loss in terms of number of tokens; however in reality, this is rare. Impermanent loss is also in the context of comparing to holding the tokens, it’s not the actual money loss.

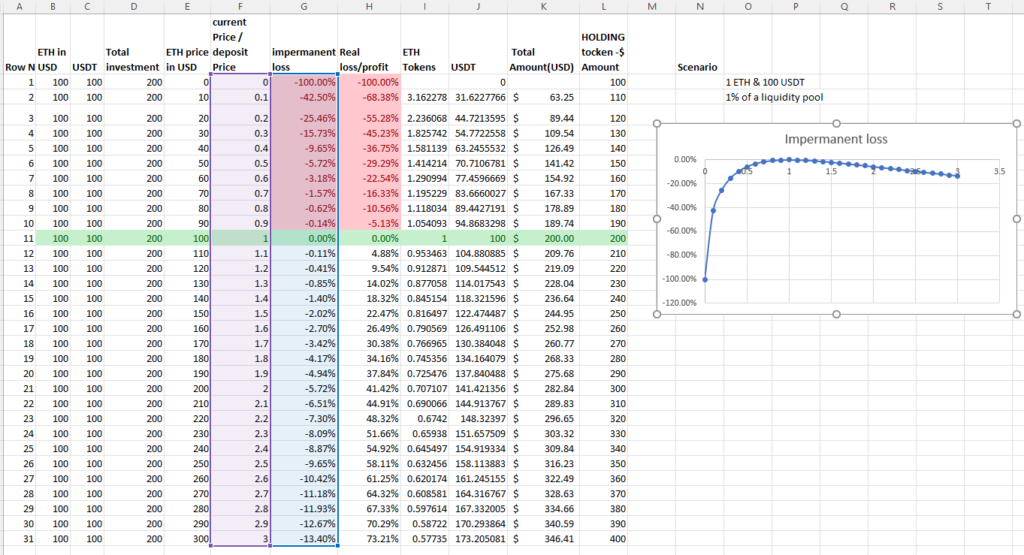

Below is a graph showing this in great detail, for simplicity reason, the scenario is ETH/USDT pool with 100 ETH and 10,000 USDT and the user owns 1% of the pool.

- Column E indicates the different price of ETH, for example the 2nd row means it’s only worth 10 USDT (i.e. 10% of the original price when the user deposited his pair into the pool)

- Column I and J show the number of tokens (both ETH and USDT but you can think USDT = USD) this user can get if he withdraws from the pool

- Column K is the equivalent $ amount for this pair, given 1 ETH = 10 USD now

- Column L is the $ amount if the user didn’t deposit the pair into the pool, i.e. just held those tokens in his wallet.

- Column G is impermanent loss, i.e. (column K – column L ) / column L, in this case -42.50%

- Column H is the actual loss, i.e. (column K – column D)/ column D (Column D is your initial capital without buying any tokens), so in this case (63.25 – 200)/200 =-68.38%

Why becoming a liquidity provider when impermanent loss is unavoidable?

You can see clearly that impermanent loss always happens unless ETH price comes back to its original $100. The impermanent loss curve (based on column F & G) on the top right also shows the loss is steeper when the token price is below its original price.

You must be wondering why people still want to be a liquidity provider given impermanent loss is unavoidable? The answer is LPs receive commissions distributed by the pool (which comes from transaction fees charged to traders in the pool), and this impermanent loss doesn’t mean capital loss when the token price is above its original price, as shown in Column H.

You could argue the liquidity provider should hold tokens therefore avoid impermanent loss completely but again, or probably more importantly, risk management is key in any investment activities, by becoming a liquidity provider, the person can realize his asset (i.e. tokens) whenever he wants, and/or is more than happy to receive a continuous income at a lower rate, in a safer manner.

Lastly, the above is a simplified explanation of UniSwap AMA algorithm, other DeFi exchanges use more complex rules and each pool can have their own fee structures and risks, do your own research as always 🙂

Final thoughts

As mentioned/implied above, becoming a liquidity provider doesn’t mean you won’t lose money(this is different than making a deposit in your bank), as a rule of thumb, you’ll lose money when your token falls below your purchase price. Based on the table above, you’ll actually lose more than holding (HODL) your tokens. Of course when this happens, you could withdraw from the pool and end up with more tokens, hoping your tokens can increase price someday in future.