The first time I saw a miner offered by Hummingbot, I was so confused: was it just a tool like GPU mining in the old days? How does it relate to Hummingbot and why does Liquidity Mining keep popping up?

After spending a few hours I finally figured out it was not a new tool, it’s just using Hummingbot to trade automatically on supported exchanges(Binance, KuCoin and another two smaller exchanges). It’s called mining simply because the exchanges/projects offer rewards which are distributed to users who participate in those trading, so miners’ income actually comes from exchanges/projects.

Why exchanges/projects want to give people money for trading? For exchanges like Binance/KuCoin, they want to encourage trading as this is their main income; for projects they want to promote their coins so this is like marketing promotion; also both exchanges and projects want to maintain stable price of coins involved.

So the logic is quite clear now: a user(i.e. miner) invests capital on buying/selling coins on supported exchanges so when price is low, Hummingbot automatically buys and when price is high, Hummingbot automatically sells; In return, the user is paid a share of total income. It’s a win-win of Hummingbot, exchange, project and miners.

So what are the risks? Below are some major ones:

- Miners capital is with exchanges ( they provide liquidity there that’s why this process is called “Liquidity Mining”): If a exchanges goes under(like the recent FTX scandal), the whole capital could be at danger

- Miners capital are buying/selling specific tokens. There are only limited tokens participating Liquidity Mining and they are normally small cap tokens so a miner’s capital could end up with totally useless tokens

- Miners capital may have better return doing something else; Exchanges charge fees so it’s possible the mining return is smaller than trading fees

Having considered all the risks, I still wanted to give it a try. I have been “mining” for almost two weeks and below are my summary so far:

- My initial investment was about 1.3K USDT on Kucoin for HOTCROSS/AVAX/FRONT

- Two weeks return was about 15 USDT. This roughly translates to 30% APY

- Trading fees were not big (less than 5 USDT) as it appeared Hummingbot didn’t trade much

In general, it’s not offering ridiculously high return (also probably because I just used all default parameters without tuning anything) but it’s fun to keep it running 🙂

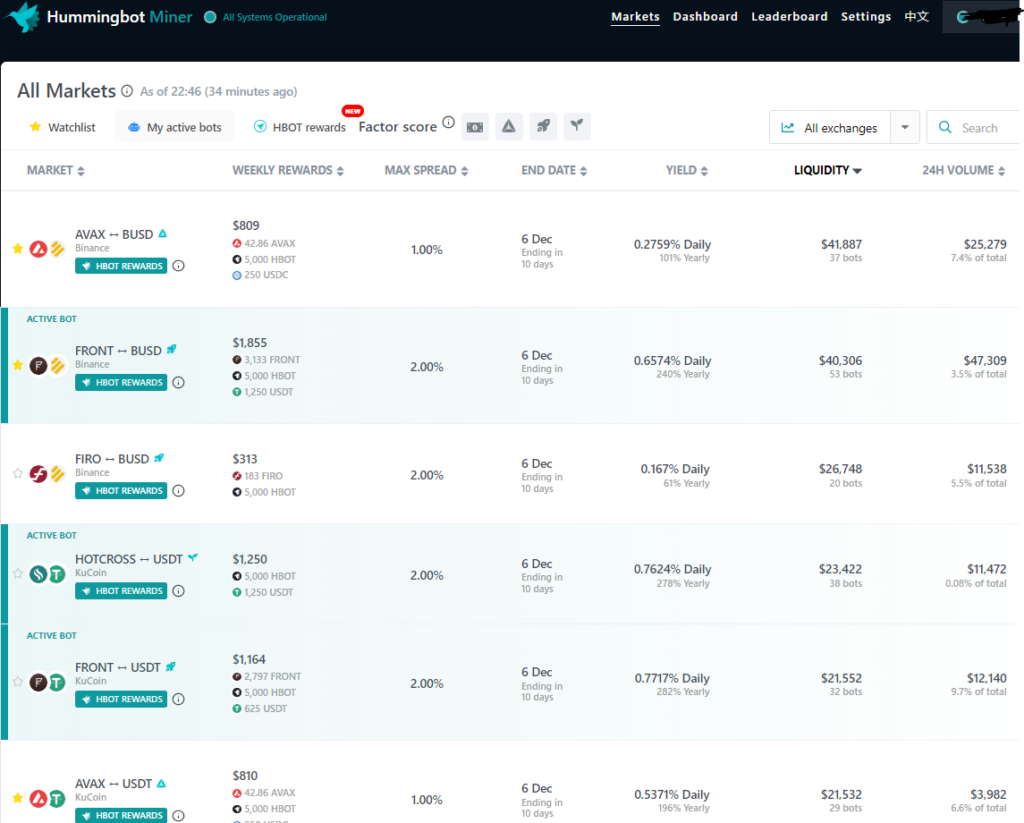

Below is the Mining dashboard for markets information as of 26/11/2022

QR code of this post 🙂