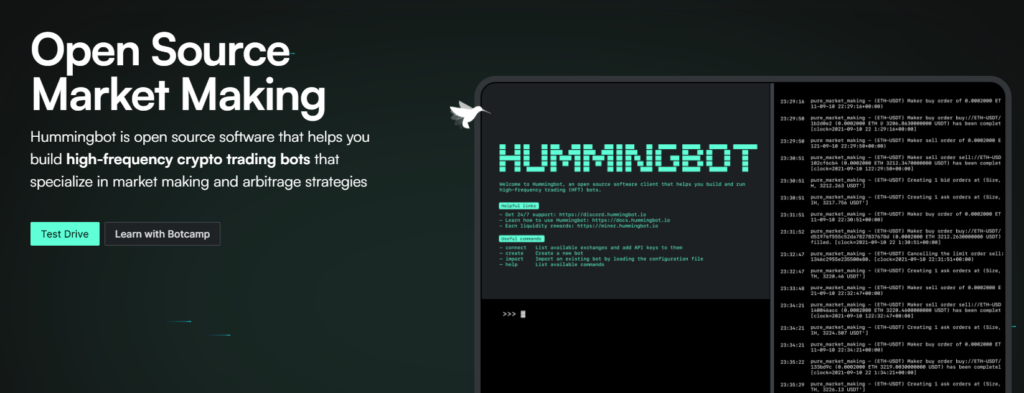

Since last post, I’ve been using Humming bot for the past couple of weeks. I’ve setup a number of bots using different strategies: Fixed grid, pure market, arbitrage and cross exchange market making.

Theoretically both arbitrage and cross exchange market making are considered risk free strategies as they don’t maintain inventory and pretty much buy low from one market and sell high in another; In practice, I actually incurred loss due to too narrow spread and delayed execution, although the loss was not significant.

I highly recommend reading the this article for detailed explanation.

I’m not going into in-depth discussion of the two strategies, below are my bullet points notes after using them:

Arbitrage(both Arbitrage and Cross-exchange) opportunities are rare: it took days for a couple of such transactions for 0.8% of buy/sell gap; when transaction cost were added (plus price change due to execution delay), I actually incurred losses. The ideal places is probably a centralised exchange(e.g. Binance) and one de-centralised exchange(e.g. QuickSwap) but I have not set such a combination.

Pure market is not guaranteed to make profit, especially during high volatile market conditions such as now after FTX collapse.

Fixed grid is not guaranteed to make profit, its ideal use scenario is relative stable price range with an overall uptrend. This strategy offers better control then those grid bots offered by exchanges such as Binance, OKX.

There are still a lot for me to learn and stay tuned for more posts on this application!